Uncollected revenue is revenue that is earned during a period but not collected during that period. Such revenues are recorded by making an adjusting entry at the end of the accounting period. The term prepaid expense is sometimes replaced with the term deferred expense.

Financial Statement Impact

Payments for goods to be delivered in the future or services to be performed is considered unearned revenue. Any service performed in one month but billed in the next month would have adjusting entry showing the revenue in the month you performed the service. More specifically, deferred revenue is revenue that a customer pays the business, for services that haven’t been received yet, such as yearly memberships and subscriptions. If you haven’t decided whether to use cash or accrual basis as the timing of documentation for your small business accounting, our guide on the basis of accounting can help you decide. For example, let’s assume that in December you bill a client for $1000 worth of service.

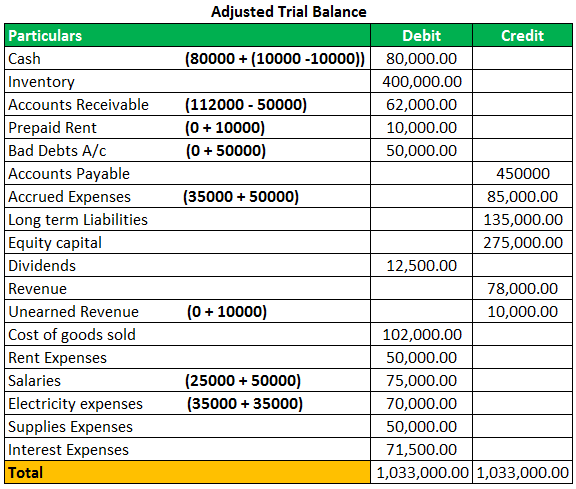

Adjusting Entries: Types, Examples, and Financial Impact

If you do your own accounting and you use the cash basis system, you likely won’t need to make adjusting entries. In August, you record that money in accounts receivable—as income you’re expecting to receive. Then, in September, you record the money as cash deposited in your bank account. You will learn more about depreciation and its computation inLong-Term Assets.

Non-Cash Expenses

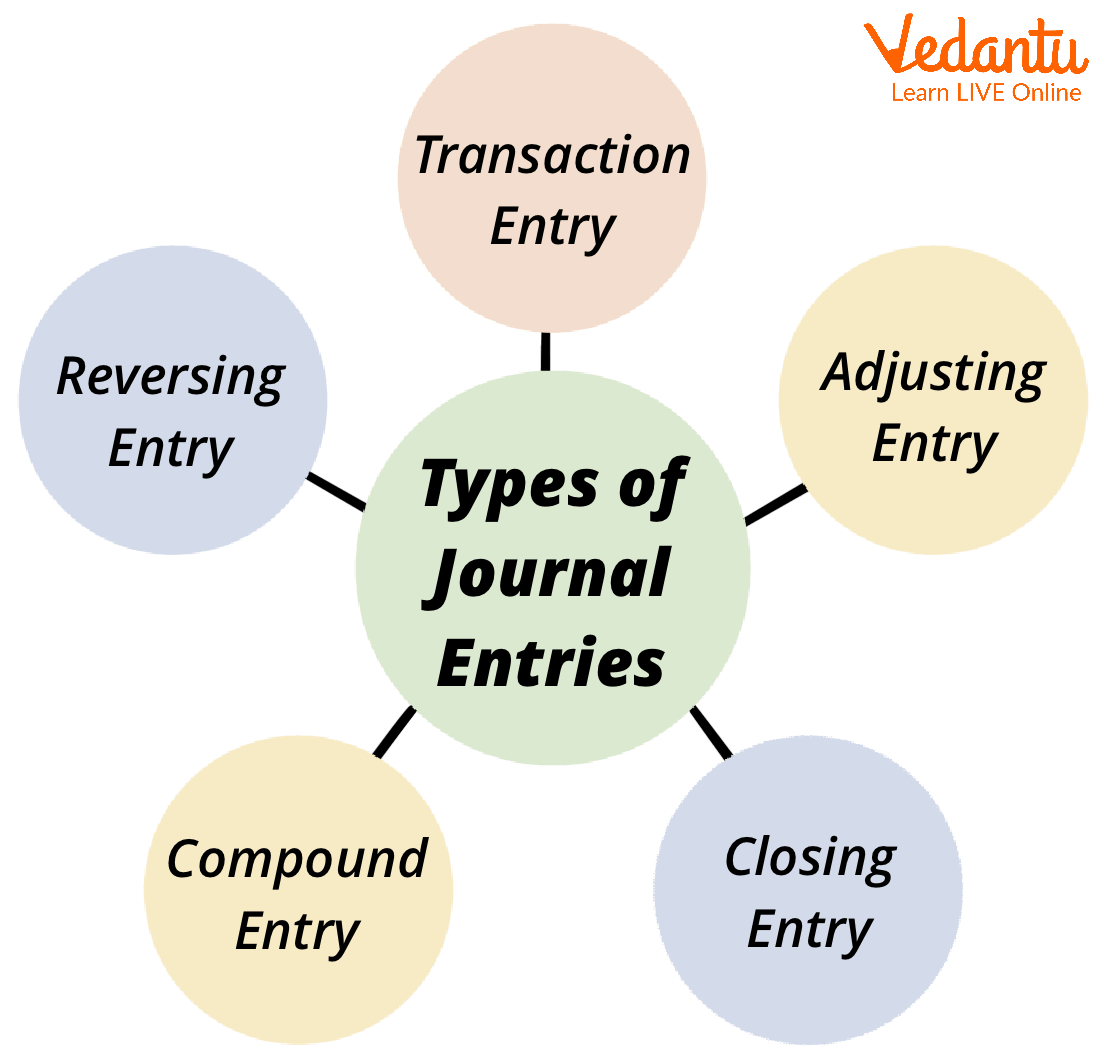

The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. There are numerous types of adjusting journals, but the four adjusting journal entries examples listed below are among the most common usually encountered. For example, going back to the example above, say your customer called after getting the bill and asked for a 5% discount.

- The balance sheet is also affected by adjusting entries, as these adjustments ensure that assets, liabilities, and equity are accurately reported.

- We at Deskera offer an intuitive, easy-to-use accounting software you can access from any device with an internet connection.

- The adjusting entry will debit interest expense and credit interest payable for the amount of interest from Dec. 1 to Dec. 31.

- Here are the main financial transactions that adjusting journal entries are used to record at the end of a period.

This video training consists of 13 videos of approximately 10 minutes each. Our visual tutorial for the topic Adjusting Entries shows you how every adjusting entry will impact both the balance sheet and the income statement. Therefore, it is necessary to find out the transactions relating to the current accounting period that have not been recorded so far or which have been entered but incompletely or incorrectly.

Assume that as ofJanuary 31 some of the printing services have been provided. Since a portion of the service wasprovided, a change to unearned revenue should occur. The companyneeds to correct this balance in the Unearned Revenue startup accounting software account. The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. With cash accounting, this occurs only when money is received for goods or services.

Without adjusting entries, financial statements may be misleading and inaccurate. Adjustment entries are an essential part of financial statements, particularly in the balance sheet and income statement. These entries are made at the end of an accounting period to ensure that the financial statements accurately reflect the company’s financial position and performance.

Accrual accounting instead allows for a lag between payment and product (e.g., with purchases made on credit). Adjusting journal entries are used to reconcile transactions that have not yet closed, but that straddle accounting periods. These can be either payments or expenses whereby the payment does not occur at the same time as delivery.

Leave a Reply